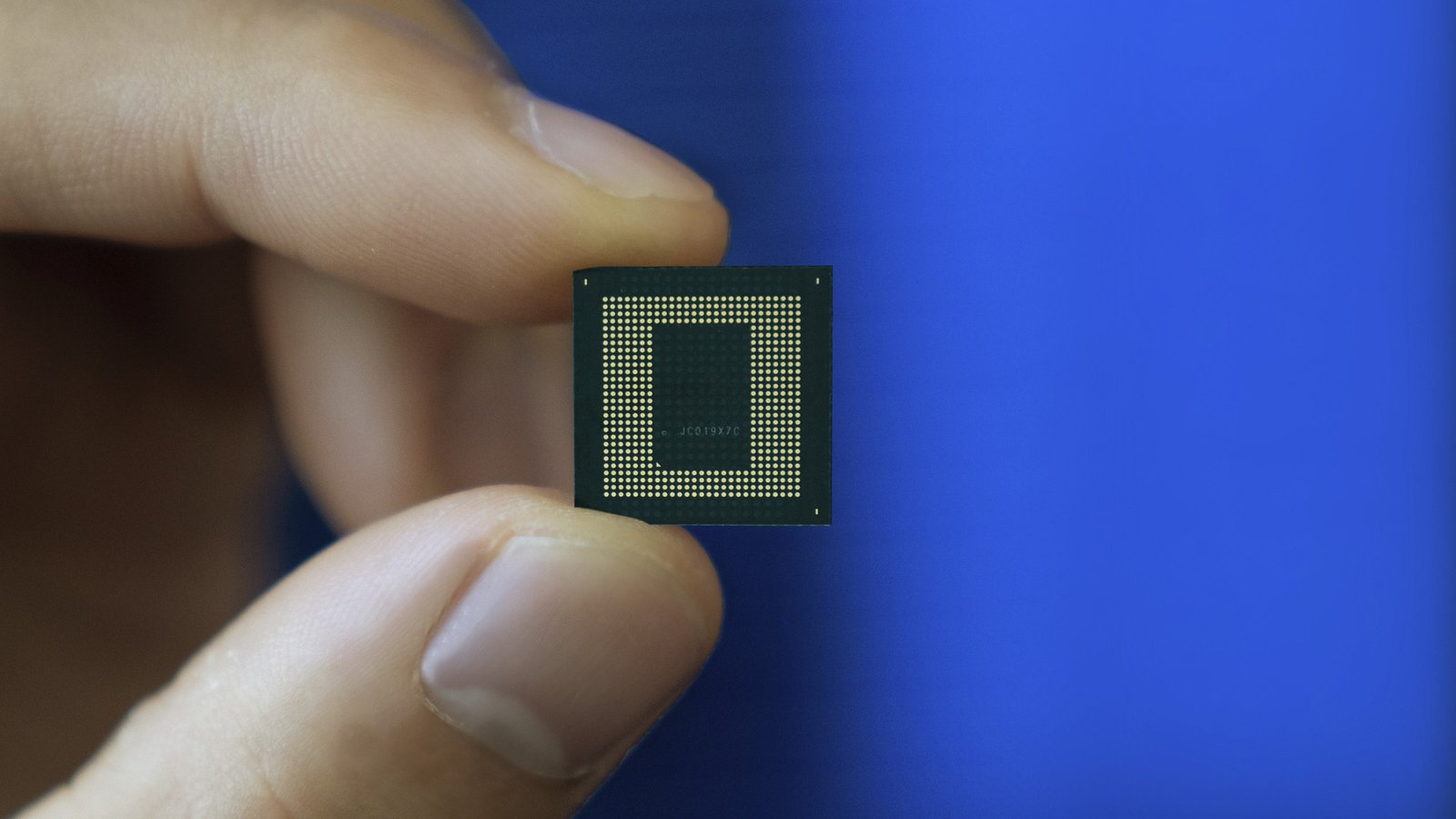

Huawei has introduced its latest flagship lineup, the Mate 60 series, featuring the company’s proprietary Kirin 9000S chip. This marks a significant shift away from relying on Qualcomm for chipsets and could potentially result in substantial losses for the American chip manufacturer.

Huawei’s return to its in-house Kirin technology underscores its determination to persevere despite the challenging US trade ban, which prohibits the company from accessing American 5G technology. While the Kirin 9000S may not match the pinnacle of performance or efficiency offered by the most powerful Snapdragon SoC, it holds the potential to help Huawei regain its footing.

Despite the US trade restrictions, Huawei had remained one of Qualcomm’s major clients for System-on-Chips (SoCs), making this transition a major setback for the latter. In 2022, Huawei procured up to 25 million units from Qualcomm, with projections of 40-42 million units for 2023.

Noted analyst Ming-Chi Kuo predicts that Huawei intends to fully embrace Kirin SoCs by 2024, a move that could result in Qualcomm losing between 50 to 60 million shipments next year—a staggering figure.

Qualcomm’s forthcoming flagship chip, the Snapdragon 8 Gen 3, is anticipated to cost $180 per unit. Consequently, if the company loses 60 million Snapdragon 8 Gen 3 shipments, it could translate into a staggering loss of $10.8 billion.

While Huawei has not disclosed plans to supply Kirin SoCs to other Chinese smartphone manufacturers, such a move, if undertaken, might offer more cost-effective alternatives compared to the potentially pricier Snapdragon 8 Gen 3, which is rumored to see a price increase.

Additionally, Qualcomm must also contend with competition from the Exynos 2400, expected to enter select markets with the Galaxy S24 lineup.