A high-level International Monetary Fund (IMF) delegation has arrived in Pakistan for critical review talks regarding the $7 billion loan program. Led by Nathan Porter, the IMF team will engage in discussions with Pakistani officials over the next two weeks, focusing on economic reforms, taxation policies, and fiscal performance.

The Federal Finance Minister, Muhammad Aurangzeb, is leading Pakistan’s delegation, which includes officials from the Finance Ministry, Federal Board of Revenue (FBR), Power Division, and State Bank. These talks will determine whether Pakistan qualifies for the next loan tranche of $1.1 billion.

Key Areas of Discussion in IMF Talks

According to reliable sources, Pakistan will present detailed reports on its economic performance and the implementation of IMF-mandated reforms. The discussions will primarily focus on:

- Progress on the $7 Billion Loan Terms:

- Pakistan is set to submit a comprehensive report outlining the measures taken to comply with IMF loan conditions.

- Economic Performance in the First Half of the Fiscal Year:

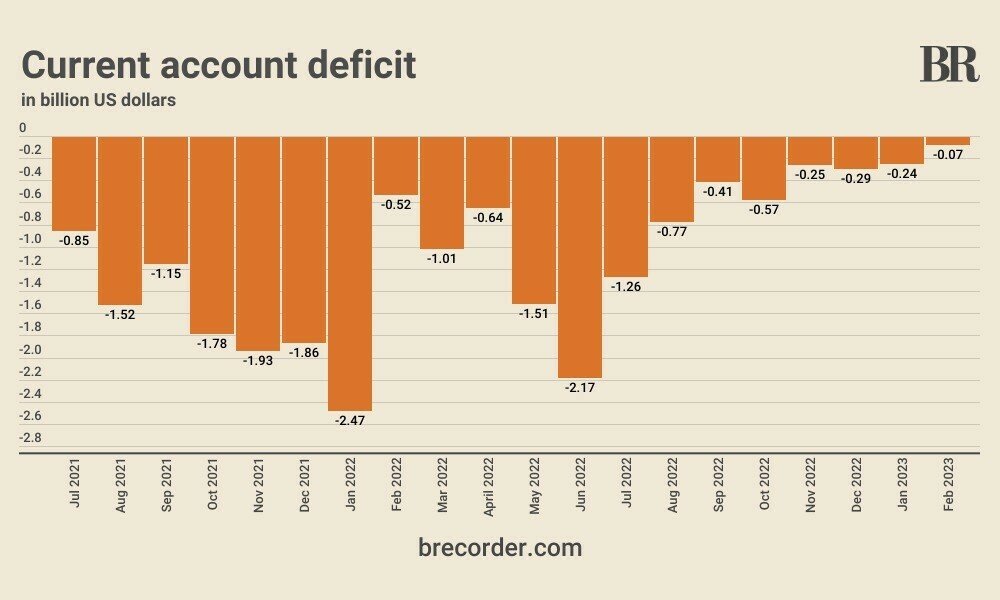

- The IMF delegation will receive a detailed briefing on Pakistan’s economic growth, revenue generation, fiscal deficit, and policy measures.

- Taxation on Agricultural and Property Sectors:

- The government will explain its efforts to bring agriculture and real estate sectors into the tax net—a long-standing demand of the IMF.

- Retailers’ Taxation Compliance:

- Pakistan will present a report on the implementation of its commitment to tax retailers and increase documentation of the informal economy.

- Energy Sector Reforms and Circular Debt Reduction:

- The Power Division will provide updates on electricity pricing adjustments, subsidy rationalization, and circular debt management strategies.

What’s at Stake for Pakistan?

The IMF review holds significant implications for Pakistan’s economic stability. The successful completion of these talks will determine the disbursement of the crucial $1.1 billion loan installment. This financial support is essential for Pakistan to maintain its foreign exchange reserves, stabilize the currency, and meet external debt obligations.

A favorable review from the IMF will:

Boost investor confidence and improve Pakistan’s standing in global financial markets.

Help maintain economic stability and avert a financial crisis.

Ensure continuation of foreign aid and investments from other international partners.

However, failure to meet IMF requirements could lead to:

Delays in loan disbursement, worsening Pakistan’s liquidity crisis.

Further currency depreciation and inflationary pressures.

Increased borrowing costs and difficulties in securing future loans.

Challenges Pakistan Faces in Meeting IMF Conditions

While Pakistan has taken steps to fulfill its IMF commitments, challenges remain:

High Inflation & Fiscal Deficit: The rising cost of living and budget deficits make it difficult to sustain economic reforms without public backlash.

Taxation Reforms Resistance: Bringing agriculture, property, and retail sectors into the tax net faces strong opposition from various interest groups.

Energy Crisis & Circular Debt: Unpaid power bills, electricity theft, and subsidy mismanagement continue to strain the energy sector.

Will Pakistan Secure the $1.1 Billion Loan?

Experts suggest that Pakistan must demonstrate significant progress in its reform agenda to convince the IMF. If Pakistan’s economic policies align with IMF expectations, there is a strong possibility that the loan installment will be approved.

However, if the IMF remains unsatisfied with Pakistan’s fiscal performance and structural reforms, the loan disbursement may be delayed or subjected to additional conditions.

The ongoing IMF negotiations are critical for Pakistan’s financial stability. With economic reforms under close scrutiny, the government must strike a balance between implementing IMF-mandated policies and managing domestic economic challenges. The next two weeks will define Pakistan’s economic future, and all eyes remain on the outcome of these crucial discussions.