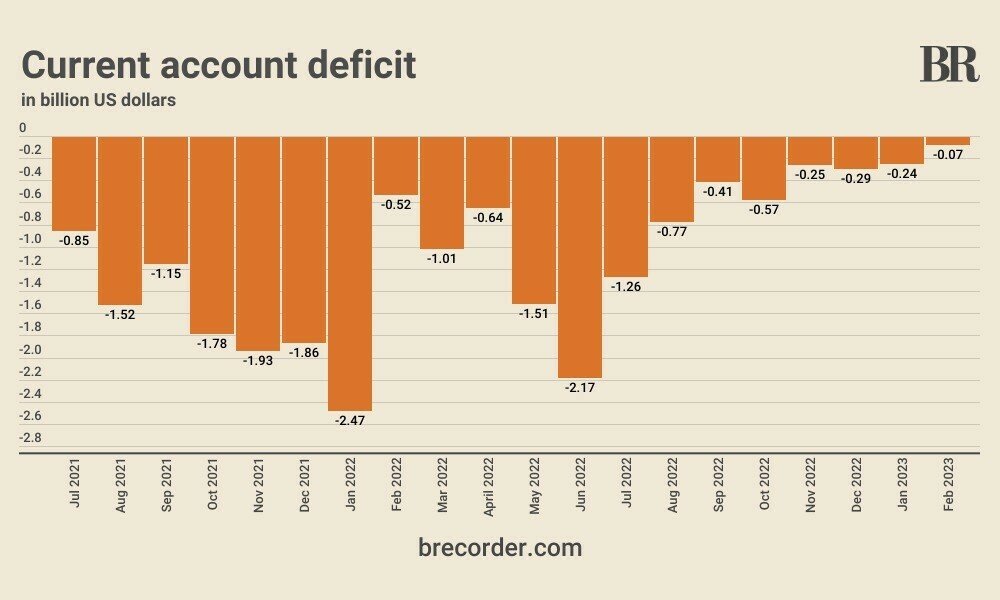

Pakistan is experiencing a substantial reduction in its current account deficit (CAD) for the financial year 2023-24, with the central bank reporting the amount at $831 million for the July-December period. This marks a significant decline of over $2.8 billion or 77% compared to the corresponding months in 2022-23, where the deficit stood at $3.63 billion.

This impressive reduction is attributed to an increase in exports and remittances, coupled with strategic measures implemented by Islamabad in response to challenges arising from rupee devaluation since April 2022. Notably, the political landscape saw the PML-N coalition successfully ousting the PTI government through a no-confidence motion during this period.

Given Pakistan’s import-oriented economy, the current account figure is crucial, as a widening deficit exerts pressure on the exchange rate and depletes foreign exchange reserves.

According to the latest data from the State Bank of Pakistan (SBP) released on Wednesday, the country recorded a current account surplus of $397 million in December 2023. This marks a substantial improvement from a $9 million surplus in November 2022 and a deficit of $365 million in December 2022.

The positive development aligns with a notable surge in Pakistan’s exports, which increased by over 14% to $3.526 billion in December 2023 compared to $3.089 billion in December 2022. Simultaneously, imports witnessed a modest 2% decline, reaching $4.97 billion in December 2023 as opposed to $4.98 billion in the same period the previous year.

Earlier reports highlighted a robust increase in remittances, with Pakistan recording $2.381 billion in December 2023, reflecting a growth of over 13% from the $2.1 billion recorded in the same month the previous year. The majority of these remittances originated from Gulf States.