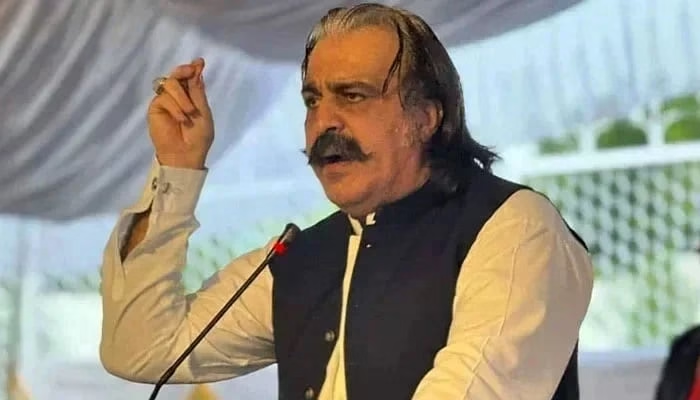

The payment of capacity charges has increased from PKR 1,082 billion to PKR 2,152 billion, primarily due to a rise in the value of the US dollar by PKR 100 to PKR 300, according to Rashed Langrial, Secretary Power Division. He expressed his concerns over the impact of this increase on electricity tariffs.

Langrial pointed out that this has resulted in the cost of capacity payments per unit (known as capacity payment per megawatt) surging from PKR 10 per unit to PKR 19 per unit. This increase has a substantial effect on the overall electricity tariffs in Pakistan.

He raised questions about the role of foreign-funded Independent Power Producers (IPPs), highlighting that they have played a significant part in driving capacity payment costs to PKR 2,152 billion. This places an enormous burden on electricity consumers in the country.

The increase in capacity payment costs is particularly pronounced for local coal-based RLNG (Re-Gasified Liquefied Natural Gas) power plants, where there has been a 60% increase, and coal-based plants funded by foreign funds, where there has been a staggering 145% increase.

Langrial, in his statement, also mentioned the exchange rate effects on the cost of capacity purchases. When the US dollar reached PKR 200, capacity payment costs per unit, with the inclusion of an indexation mechanism, escalated to PKR 1,617 billion.

He suggested that the government should renegotiate the terms of its agreements with foreign-funded power projects and extend the repayment period from 10 to 25 years. This would provide relief to electricity consumers in Pakistan.

Furthermore, Langrial emphasized that the government should shift its focus from immediate coal imports to locally sourced coal for power generation. Utilizing coal from local mines for all power projects can significantly reduce the cost of electricity production.

However, it is worth noting that the government needs to learn from previous experiences, especially in cases like the 660-megawatt solar power plant project, where adjustments to the open-ended tariff system resulted in an 80% dollar indexation, a departure from the previous 14 PKR per unit impact.

Additionally, the government’s decision to invest in coal-based power plants in Gwadar, capable of generating 300 megawatts of electricity, and five nuclear power plants with a combined capacity of 1,200 megawatts indicates a significant shift in policy. These initiatives aim to capitalize on the existing capacity of 45,000 megawatts, offering the potential to alleviate the burden on consumers, provided that the government manages these projects efficiently.

Pakistan is grappling with rising electricity costs due to the depreciation of its currency and the terms of agreements with foreign-funded power projects. Revisiting these agreements, promoting locally sourced coal, and efficiently managing power generation initiatives are essential steps to mitigate the impact on consumers and ensure energy sustainability in the country.