Artificial intelligence could drive down oil prices over the next decade by increasing supply through cost reductions and improving logistics, Goldman Sachs reported on Tuesday.

Why It’s Important

While much of the focus on AI’s impact on energy has been on the demand side, particularly in boosting power consumption, its potential to lower oil prices could negatively affect the incomes of major producers, including OPEC+ members.

Key Quotes

“AI could potentially reduce costs via improved logistics and resource allocation, leading to a $5 per barrel drop in the marginal incentive price, assuming a 25% productivity gain observed for early AI adopters,” Goldman Sachs noted.

Goldman also expects AI to have a modest impact on oil demand compared to its influence on power and natural gas over the next decade. “We believe AI is likely to be a modest net negative to oil prices in the medium-to-long term, as the reduction in costs (around $5 per barrel) would likely outweigh the demand boost (around $2 per barrel),” the firm stated.

By the Numbers

Goldman Sachs estimates that AI could reduce the costs of a new shale well by about 30%. Additionally, AI could boost oil reserves by 8% to 20% (10-30 billion barrels) through a 10% to 20% increase in U.S. shale recovery rates.

Context

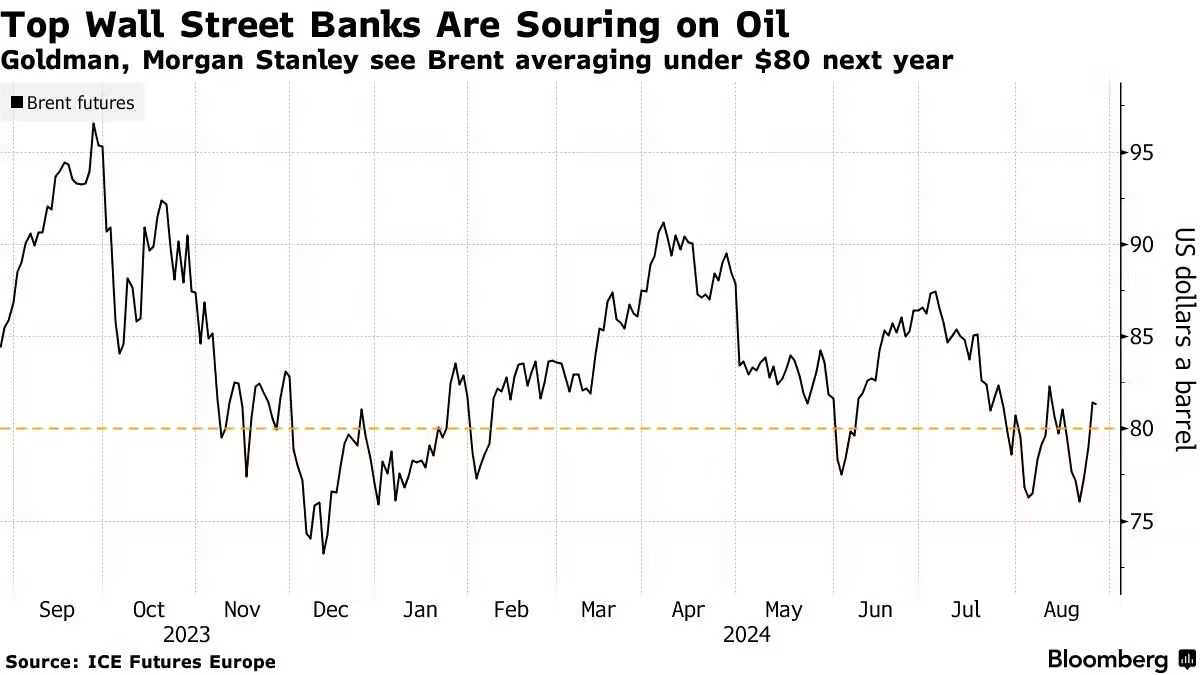

Brent crude futures recently fell by $3.51, or 4.5%, to $74.02 per barrel, the lowest level since December. West Texas Intermediate crude futures also dropped by $2.97, or 4.1%, to $70.58, marking their lowest price since January.

Meanwhile, U.S. technology companies are increasingly targeting energy assets held by bitcoin miners to secure the shrinking electricity supply needed for their expanding AI and cloud computing data centers.