As Pakistan grapples with soaring energy prices, the International Monetary Fund (IMF) emphasizes that recent hikes in electricity and gas tariffs were crucial to bolster the energy sector’s viability. However, the IMF underscores that more comprehensive reforms are essential to address structural issues.

The first review of the stand-by arrangement, outlined in an IMF report, acknowledges significant actions taken by Pakistan’s caretaker government in the power and gas sectors to curb the escalation of circular debt. This debt, reaching around 5.25% of GDP by the end of the last fiscal year 2022-23, prompted the recent increases in electricity and gas tariffs.

The IMF report reveals that energy subsidies are limited to Rs976 billion in the 2023-24 budget, resulting in record-high tariff levels. This has led to a cost-of-living crisis and unprecedented challenges for businesses in the country.

The IMF stresses the critical importance of timely implementation of scheduled tariff adjustments and broader reform efforts to restore the viability of the energy sector. In terms of GDP, the IMF predicts a 2% growth rate for the current financial year, citing an improvement in foreign reserves from $4.2 billion to $8.2 billion.

While Pakistan achieved the targets set for the first quarter of the fiscal year, the industrial sector faces difficulties with a growth rate of only 2.5%. This is attributed to the impact of increased energy tariffs and interest rates, contributing to the highest cost of doing business in the country’s history. On a positive note, the agriculture sector witnessed a growth rate of 5.1%.

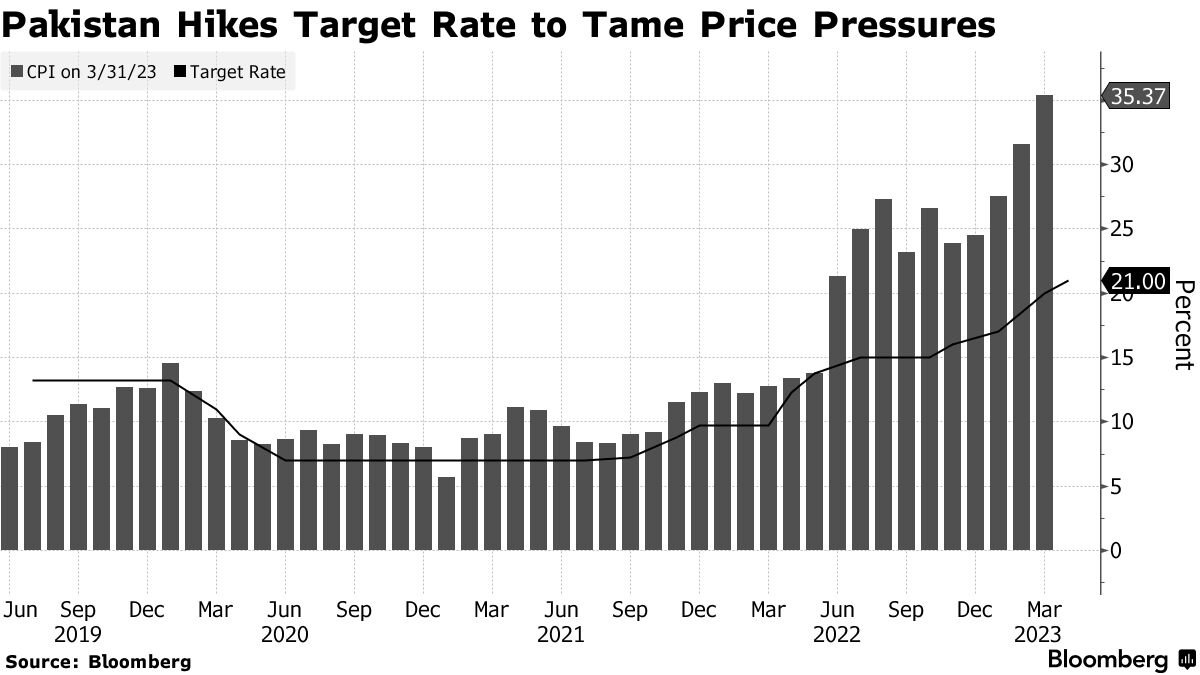

Addressing inflation, the IMF notes a recorded rate of 36% in May, which decreased to 26.8% in October. However, the report does not mention the subsequent increase, particularly in food inflation, pushing the Sensitive Price Indicator (SPI) to 44.64% on a year-on-year basis as of the week ending January 18.

The IMF welcomes improved revenue collection, which has helped restrain the widening deficit, and acknowledges Pakistan’s efforts to curb cross-border smuggling of the US dollar. The IMF forecast predicts a budget deficit of around 7.6% of GDP, with the current account deficit hovering around 1.6% of GDP. Recent official data also indicates a significant reduction in the current account deficit during the first six months of 2023-24.