China faces a critical challenge to its economic objectives as its rapidly aging population, comprising over 60s, now stands at 296.97 million, constituting about 21.1% of the total population. This demographic shift poses a threat to Beijing’s plans of boosting domestic consumption and managing burgeoning debt in the coming decade.

Pension System Overview: China’s pension system comprises three pillars, with the state leading the basic pension system. The second pillar involves a voluntary employee pension plan from employers, while the third pillar consists of private voluntary pension schemes. Despite being the largest social security system globally, concerns arise over the underdeveloped corporate and private schemes, putting additional strain on the already pressured public scheme, primarily administered at the provincial level.

Regional Disparities and Pension Deficits: Certain regions, particularly in the north, face significant pension deficits due to weaker economies and population outflows. To address this, China established a fund in 2018 to redistribute pension funds from affluent coastal provinces to less prosperous areas.

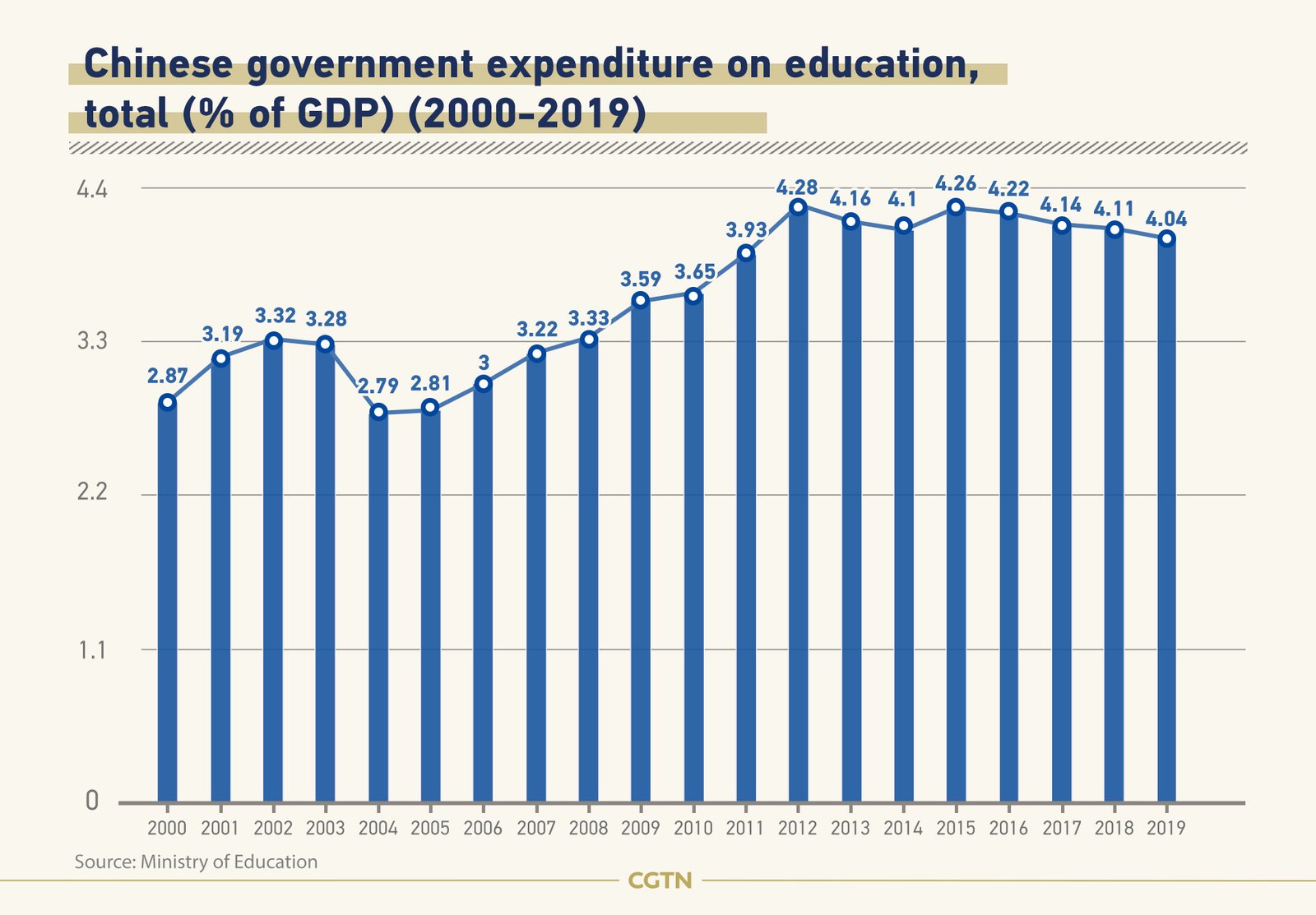

Financial Pressures and Projected Shortfalls: China’s public pension expenditure already exceeds 5% of its GDP, with projections suggesting the state pension system could run out of funds by 2035, as estimated by the Chinese Academy of Sciences.

Retirement Age and Life Expectancy: While Chinese citizens traditionally collect pensions upon retirement at age 60 for men, 55 for white-collar women, and 50 for women in factories, China’s rising life expectancy (projected to exceed 80 by 2050) and an aging population present challenges to the current retirement age structure.

Reform Efforts and Slow Progress: Despite a blueprint unveiled in 2022 to support the aging population, including plans for more nursing homes and a new private pension scheme, pension system reforms have been slow. Calls for raising the statutory retirement age have been met with resistance on social media, reflecting concerns about the challenging working environment and high unemployment.

Demographic Shifts and Future Projections: The working-age to retiree ratio has drastically changed from ten supporting one retiree in 2002 to an anticipated ratio of two in 2050. The implications of this demographic transition raise questions about the sustainability of China’s pension system and its broader economic implications.