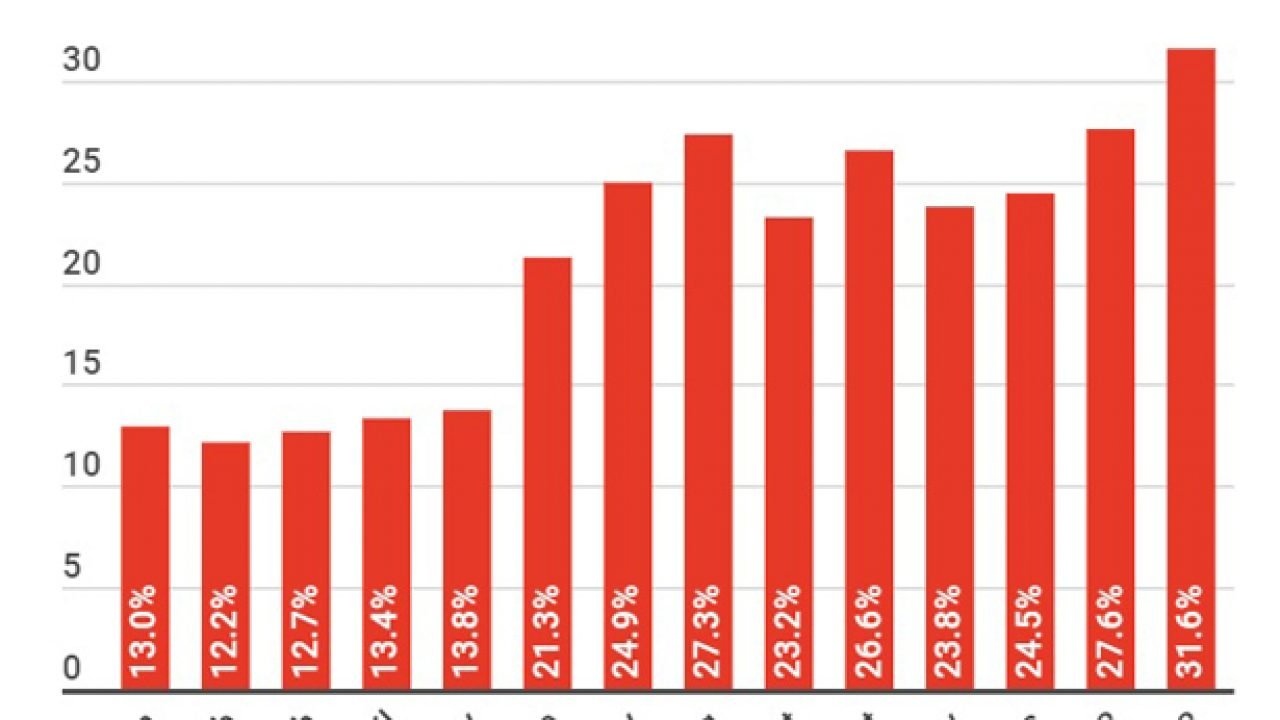

The Sensitive Price Indicator (SPI) in Pakistan has surged to 43.25% year-on-year, with food inflation and escalating energy tariffs compounding the country’s cost-of-living crisis. Chicken, eggs, and vegetables contributed to the upward trend, impacting purchasing power amid stagnant wages. The government’s focus on booming food exports has led to reduced domestic supply and rising prices, highlighting a lack of effective policy. The Pakistan Bureau of Statistics reports an SPI of 311.14 for the week ending December 29. Despite predictions from the central bank, there are concerns that inflation may persist, affecting interest rates and economic growth. The upcoming February 8 elections may offer a chance for stability and economic reform.

Pakistan’s inflation woes continue as SPI rises to 43.25% year-on-year.