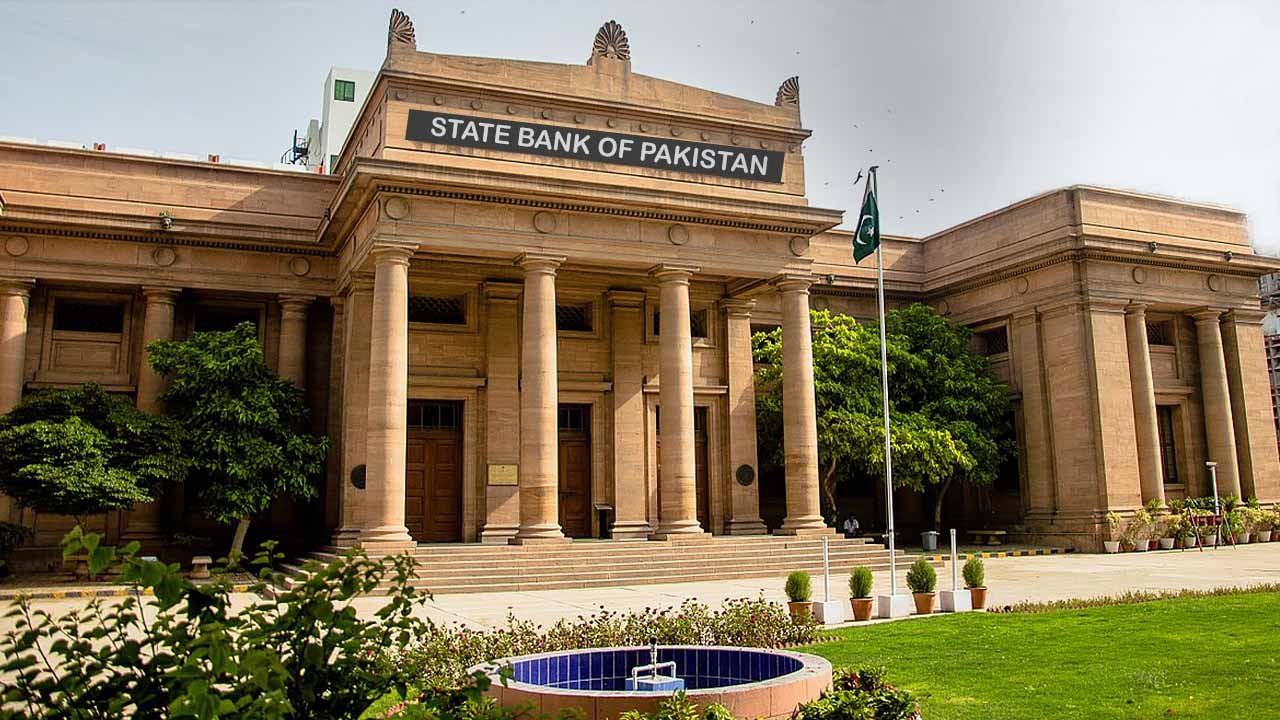

In its fourth consecutive policy meeting, the State Bank of Pakistan (SBP) is anticipated to keep its key policy rate steady, according to analysts. The current rate, at an all-time high of 22%, has remained unchanged for the past three meetings. The challenging economic recovery path faced by Pakistan, coupled with inflation concerns, has made the central bank’s decision crucial. While there is a consensus for no change in rates, one analyst suggests a potential 100 basis point cut. Analysts expect inflation to gradually ease in the coming months, potentially paving the way for rate cuts to stimulate the economy. The nation recently secured a $3 billion loan program from the International Monetary Fund (IMF) in July, which helped prevent a sovereign debt default but imposed conditions complicating inflation control efforts. The market outlook hints at a gradual rate reduction in the first half of the next year, contingent on the inflation trajectory.

Usman Zahid, Director of Research at AKD Securities, emphasized the persistence of high inflation and negative real interest rates, asserting that a rate cut is not justified at this juncture. He anticipates annual inflation to start easing from February 2024. November witnessed a 2.7% month-on-month surge in inflation, primarily attributed to increased gas prices. However, annual inflation for November stood at 29.2%, a slight uptick from October but significantly lower than the peak of 38% in May. Investors have factored in the anticipated peak in Pakistan interest rates, contributing to the buoyancy in stock markets and the currency. Pakistan’s benchmark index recently reached an all-time high, reflecting positive sentiments.

Mohammad Sohail, CEO of Topline Securities, expressed optimism in the stability of the currency, a low current account deficit, and a projected decline in inflation in the coming months. He suggested that the SBP committee members might consider adjusting rates downwards, with a potential 100 basis point reduction in the upcoming meeting.