Malaysian palm oil futures extended losses for a third straight session as a stronger ringgit and softer early-February export estimates weighed on sentiment.

The benchmark April contract slid to around 4,048 ringgit per tonne, pressured by currency strength that makes Malaysian cargoes more expensive for overseas buyers. Traders also tracked rival edible oils: Dalian palm oil futures weakened, while Chinese and Chicago soyoil prices edged higher. Despite the mixed trend, softness in substitute oils added downside pressure on palm oil.

On the policy side, Malaysia raised the March crude palm oil (CPO) reference price to RM3,896.09 per tonne, up from RM3,846.84 in February, but kept the export duty unchanged at 9%, offering little fresh support to prices. Under Malaysia’s tax structure, duties begin at 3% for lower price bands and are capped at 10% when prices exceed RM4,050 per tonne.

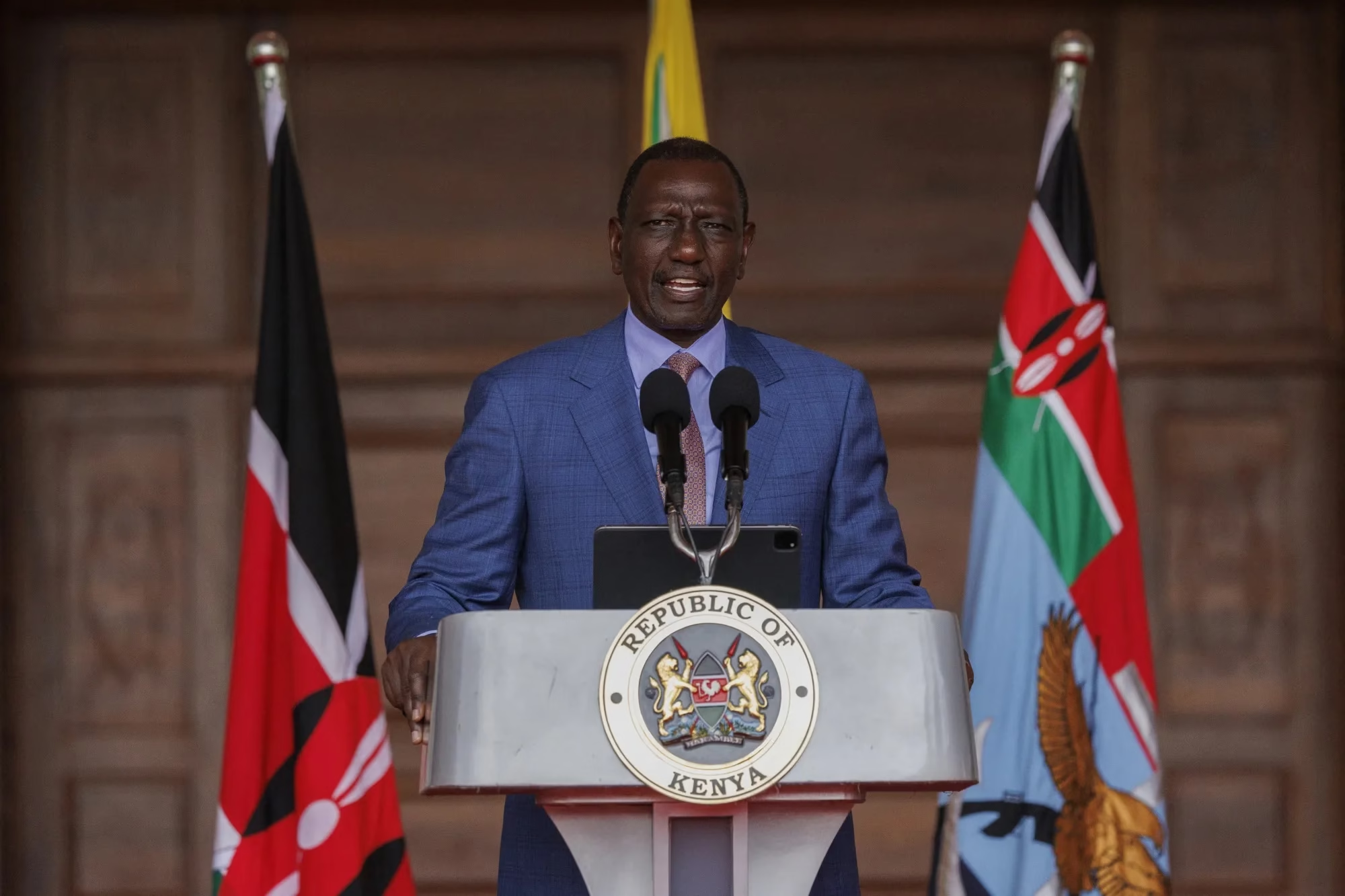

Meanwhile, India and Malaysia agreed to deepen cooperation in semiconductors and high-tech sectors during Prime Minister Narendra Modi’s visit — his first to Malaysia in over a decade. Agreements were signed covering renewable energy, healthcare, artificial intelligence, and semiconductor collaboration.

Malaysia — the world’s sixth-largest semiconductor exporter — derives roughly a quarter of its GDP from the sector. Trade between the two nations remains robust: India exported about $7.32 billion in goods last year, mainly engineering and petroleum products, while imports from Malaysia totaled $12.54 billion, largely minerals, vegetable oils, and electrical equipment.

Together, the developments highlight how currency moves, export dynamics, and policy signals are shaping palm oil markets, even as Malaysia expands broader economic partnerships.