Packaged food makers and fast-food chains are expected to overhaul more of their products next year as newly approved appetite-suppressing GLP-1 weight-loss pills become available, analysts say.

The U.S. Food and Drug Administration this week approved Novo Nordisk’s Wegovy GLP-1 pill, which is set to launch in January. The approval sent shares of several food companies lower on Tuesday, reflecting investor concerns that broader adoption of weight-loss drugs could reshape long-term consumer demand. Rival pill-based treatments from Eli Lilly are expected to gain regulatory approval next year.

Analysts believe pill-based GLP-1 drugs will attract more users than injectable versions because they are expected to be cheaper and easier to use, removing a key barrier for patients hesitant to self-inject.

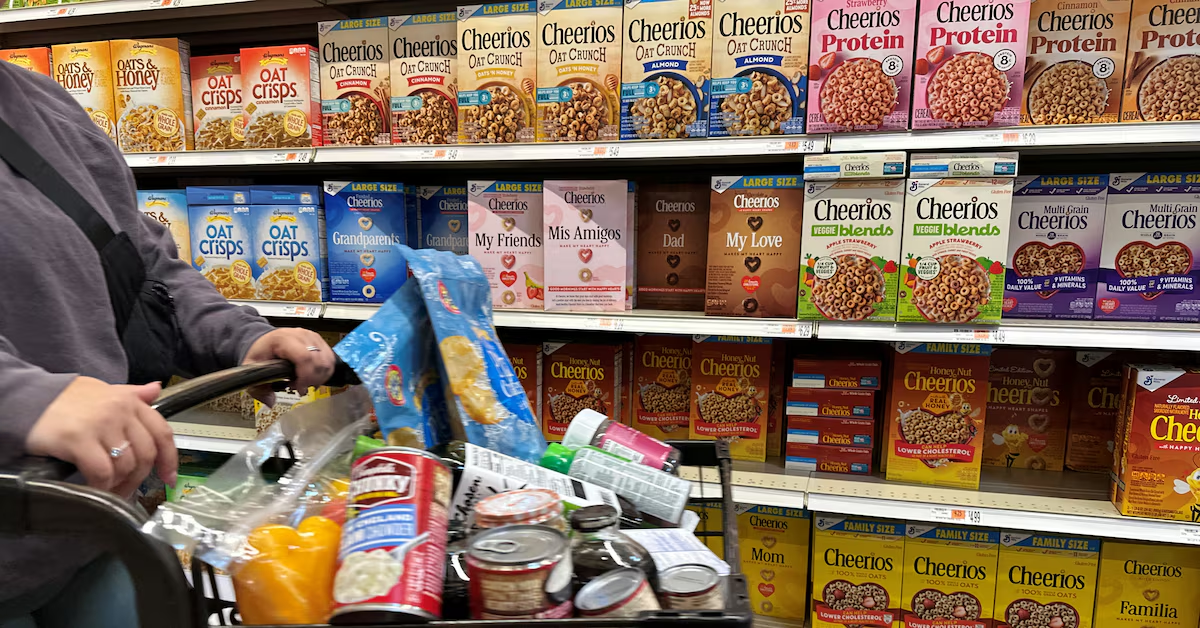

Food companies such as Conagra Brands and Nestlé are already responding to shifts in consumer behavior linked to GLP-1 injections, including preferences for higher-protein foods and smaller portions. Wider use of pill-based treatments could accelerate those changes.

“We are seeing people cut back specifically on salty snacks, liquor, soda, drinks and bakery snacks, and focus more on protein and fiber,” said JP Frossard, consumer foods analyst at Rabobank. “We expect food companies and restaurants to cater to this audience, which is growing.”

Andrew Rocco, stock strategist at Zacks Investment Research, described the FDA approval as “groundbreaking,” noting that the pill version delivers similar weight-loss results at a lower cost. “High protein, smaller portions, and functional food innovation will be necessary,” he said.

Food companies take note

About 40% of U.S. adults are obese, according to government data, while roughly 12% currently use GLP-1 drugs, a recent poll by health policy research organization KFF found.

A new Cornell University study, based on purchase data from about 150,000 households collected by Numerator, showed that households using GLP-1 medications reduced grocery spending by 5.3% and fast-food spending by nearly 8% on average. Spending largely rebounded after households stopped using the drugs.

“These decreases will likely show up across a much broader segment of the population” as pill-based GLP-1 drugs become more widely available, said Sylvia Hristakeva, a co-author of the study. She added that lower prices and easier use could lead patients to stay on the medications longer.

While the study found modest spending increases only in categories such as yogurt and fresh fruit, food companies are already adjusting strategies.

Earlier this year, Conagra began labeling select Healthy Choice frozen meals as “GLP-1 friendly,” highlighting high protein and fiber content. A company spokesperson said those products are outperforming similar meals without the labeling. Conagra plans to launch additional recipes under the same branding in May and expand marketing efforts with retailers such as Walmart and Kroger.

French dairy group Danone, maker of Oikos Greek yogurt, said it is seeing double-digit growth in its high-protein products, a trend that has accelerated alongside GLP-1 adoption.

Nestlé, the world’s largest food company, has also launched frozen meals tailored to GLP-1 users under its Vital Pursuit brand.

Restaurants are following suit. Chipotle this week introduced a High Protein Menu, including single-portion servings of chicken or steak. Other chains, including Olive Garden, have recently added smaller and lower-priced portions.

“Noodles & Company” marketing chief Stephen Kennedy said the changes are aimed at giving customers “options that satisfy without going overboard.”