Kenya has applied for a fresh lending programme from the International Monetary Fund (IMF), incorporating unused funds from the previous agreement, according to Finance Minister John Mbadi.

The decision follows last week’s mutual agreement between Kenya and the IMF to abandon the ninth and final review of the current programme, which was set to conclude next month. This led to a decline in Kenya’s dollar bonds.

Mbadi clarified that the decision was due to time constraints rather than any disagreements over unmet targets. Reports suggesting a fallout with the IMF were dismissed, with the minister emphasizing that Kenya’s economic fundamentals had improved.

Approximately $800 million remains unused from the previous programme, which was initiated in April 2021. The original agreement consisted of $3.6 billion in Extended Credit Facility and Extended Fund Facility support, along with $541.3 million from the Resilience and Sustainability Facility. By last October, $3.12 billion and $180.4 million had been disbursed, respectively.

While the IMF has yet to comment on Kenya’s new request, discussions are expected to take place soon. S&P Global Ratings cautioned that any delays in IMF funding could impact Kenya’s ability to lower debt-servicing costs and potentially postpone other financial inflows, including $800 million from the World Bank and $1.5 billion from the UAE.

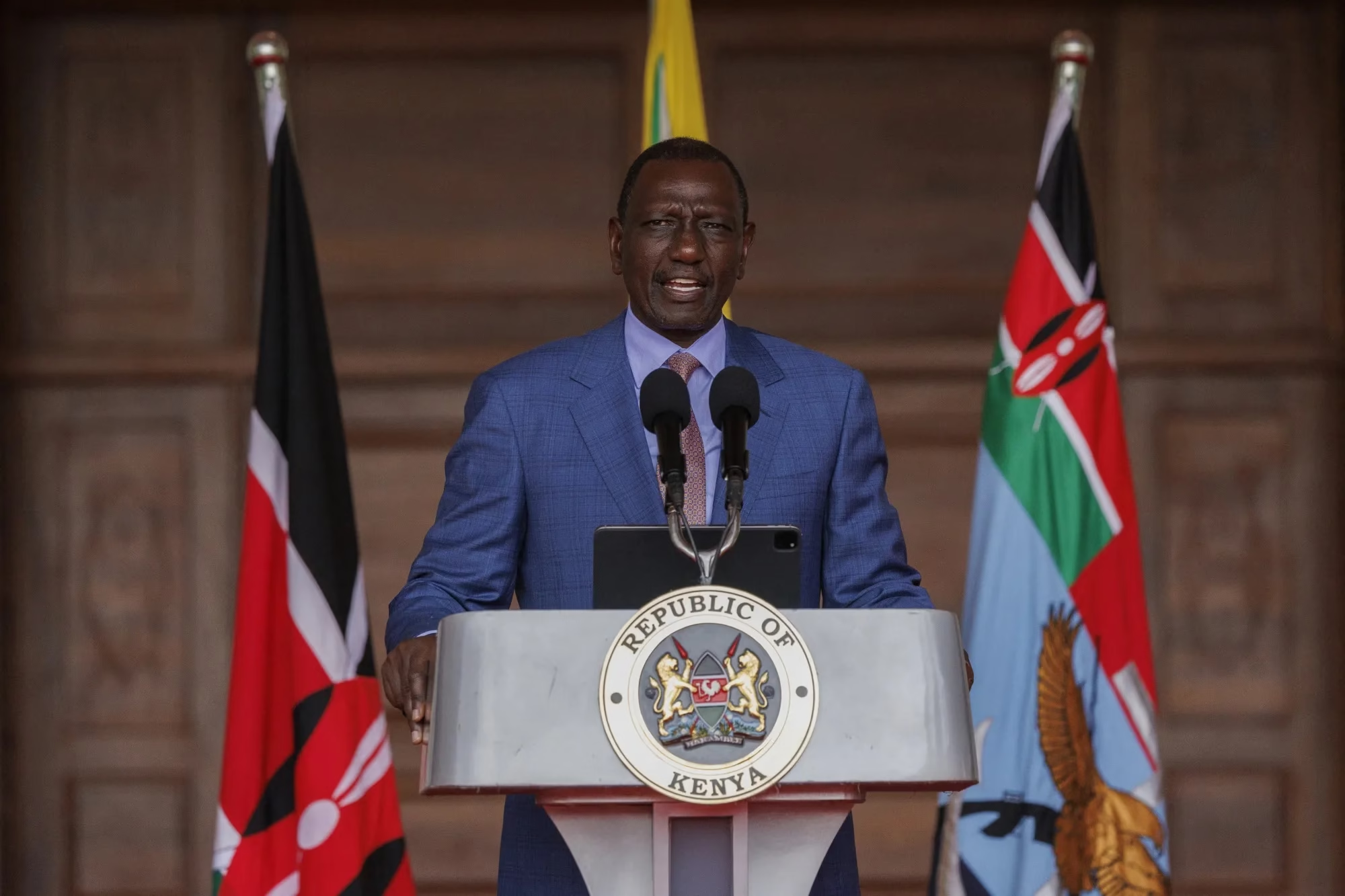

Despite the challenges, Mbadi remains optimistic about securing a new agreement in the upcoming fiscal year starting in July. The Kenyan government, led by President William Ruto, continues efforts to stabilize the economy following years of mounting debt and fiscal strain.