Shares of Intuitive Machines dropped 24% on Friday after the company confirmed that its second lunar lander, Athena, landed on its side—a repeat of its first mission’s outcome last year.

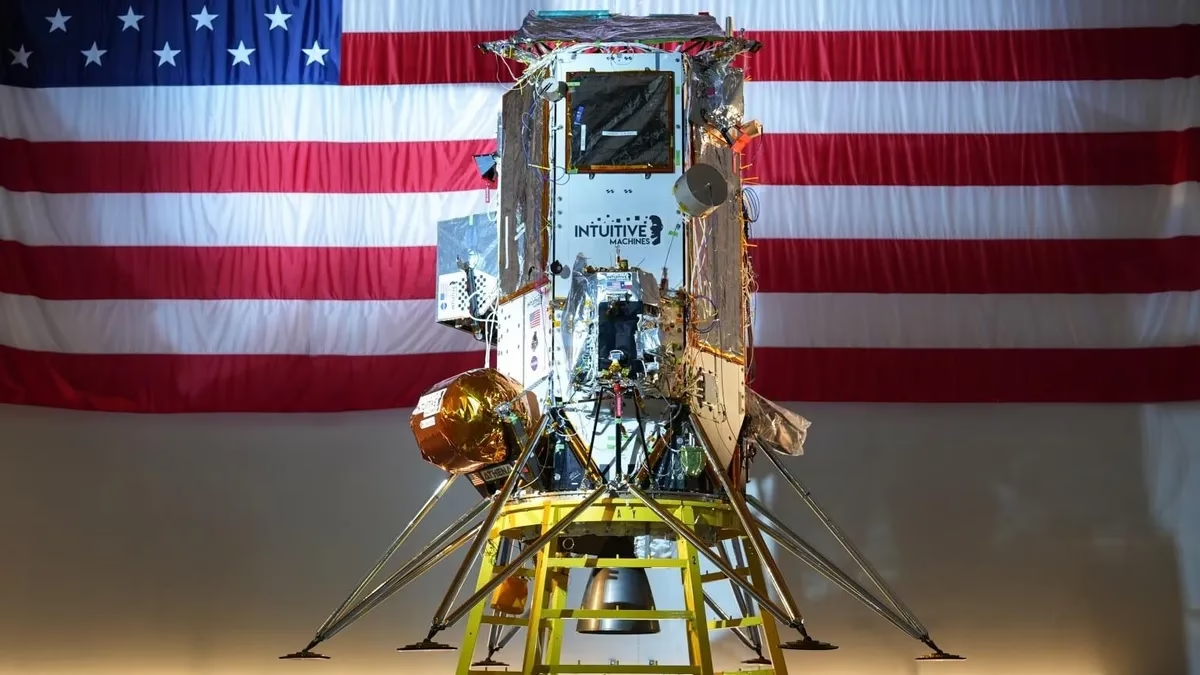

The six-legged lander successfully touched down approximately 100 miles (160 km) from the Moon’s south pole, but its mission was cut short after it ended up on its side, despite achieving several mission milestones.

“With the sun’s direction, the solar panel orientation, and extreme cold temperatures in the crater, Athena is unlikely to recharge,” the company stated.

The setback triggered Intuitive Machines’ biggest stock drop in over a year after shares had surged over 100% in the past 12 months.

Athena’s Mission and Future Plans

Athena carried 11 payloads and scientific instruments, including:

✅ A drill to search for water ice and lunar resources

✅ The first data center on the Moon

✅ A cellular network for lunar communication

Meanwhile, SpaceX’s Starship—the world’s largest rocket—exploded minutes after launch on Thursday, scattering debris off the coast of Florida and the Bahamas in its second consecutive failure.

As part of NASA’s Commercial Lunar Payload Services (CLPS) program, Intuitive Machines remains a key player in the agency’s strategy to revive lunar exploration at lower costs. The company may delay its third lunar landing mission, scheduled for next year, to wait for the deployment of its communications satellite, CEO Steve Altemus said.

NASA has also awarded the company a fourth mission in 2027, aimed at delivering six payloads that could provide insights into the origin of water across the solar system.

Competitors and Industry Outlook

While Intuitive Machines faced challenges, Austin-based Firefly Aerospace achieved a successful lunar landing over the weekend with its Blue Ghost lander, marking a major milestone for private space exploration.

Despite setbacks, analysts remain cautiously optimistic. Andres Sheppard, senior analyst at Cantor Fitzgerald, acknowledged the credibility concerns but still sees Intuitive Machines as one of the better-positioned companies in the industry.

“In our view, this is not an indication of a dire situation for the company,” Sheppard said.