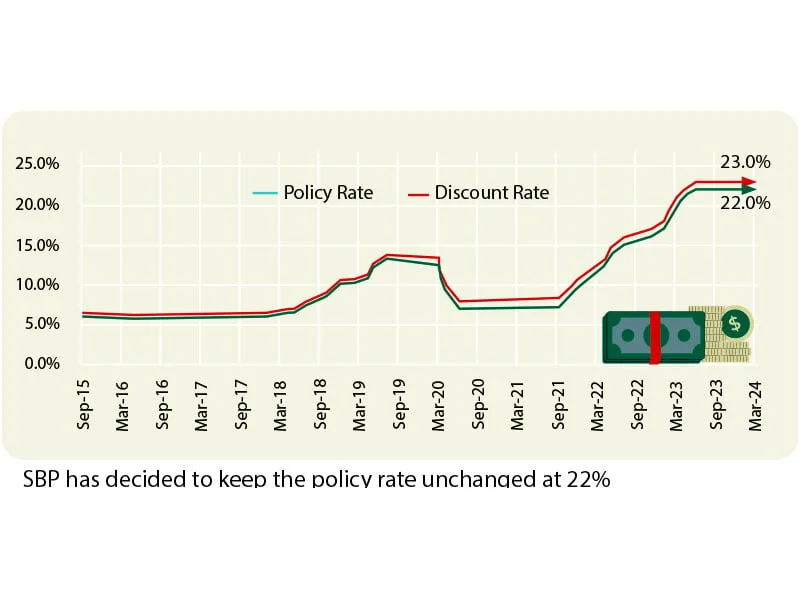

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) announced a significant 150 basis points reduction in the policy rate to 20.5 percent, effective from June 11, 2024. This decision marks the first change in the interest rate in the past year, following seven consecutive sessions of maintaining stability by the central bank.

The MPC’s decision came against the backdrop of moderate GDP growth and a downtrend in inflation. Notably, while inflation has decreased significantly since February, the May figures surpassed earlier expectations, reflecting improved economic conditions. The Committee observed a gradual easing of underlying inflationary pressures, supported by the rigorous monetary policy stance and fiscal consolidation efforts.

Despite the positive indicators, the MPC acknowledged potential risks to the inflation outlook, particularly associated with forthcoming budgetary measures and uncertainties regarding energy price adjustments. However, the Committee expressed confidence that the cumulative impact of previous monetary tightening measures would help contain inflationary pressures.

The MPC highlighted key developments since its last meeting, including moderate real GDP growth of 2.4 percent in FY24, improvements in the current account deficit leading to enhanced foreign exchange reserves, and the government’s engagement with the IMF for financial support.

Furthermore, international oil prices have decreased, although non-oil commodity prices have seen a slight uptick. Considering these factors, the Committee concluded that the timing is conducive to lowering the policy rate.

The decision to reduce the policy rate was underpinned by the realization that the real interest rate remains significantly positive, a crucial factor in guiding inflation towards the medium-term target of 5 – 7 percent.

Overall, the SBP’s policy adjustment reflects a balanced approach aimed at supporting economic growth while maintaining price stability in line with the country’s monetary policy objectives.