A recent report by the European Union Chamber of Commerce in China highlights growing uncertainties and stringent regulations, significantly elevating risks for foreign enterprises operating in the country.

The comprehensive paper underscores the urgent need for Chinese leaders to address mounting concerns that have intensified in recent years.

In the face of an increasingly politicized global business environment, companies are confronted with challenging decisions regarding their continued engagement with the Chinese market, as stated in the report.

Collaboratively compiled by the chamber and the China Macro Group consultancy, the study resonates with apprehensions voiced by both European and American corporations operating in China. Foreign investment experienced an 8% decline last year, reflecting companies’ reassessment of their commitments in the world’s second-largest economy.

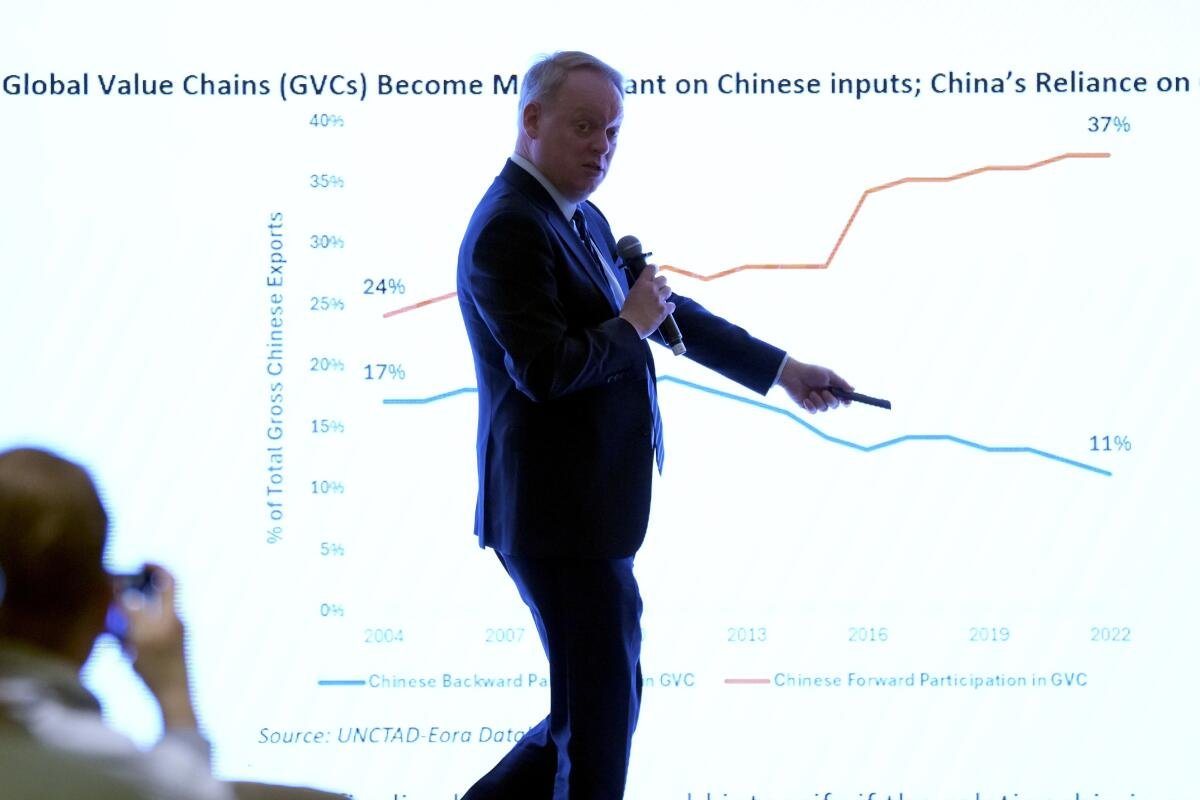

EU Chamber officials noted that China’s evolving business landscape partly stems from Beijing’s efforts to mitigate risks amidst trade tensions and dependence on critical imports. This cautious approach gains prominence amid trade disputes with Washington and deliberations about supply chain “decoupling” following disruptions during the COVID-19 pandemic.

Despite China’s claims of openness to foreign investment, several actions contradict this narrative. Instances such as raids on foreign enterprises, ambiguous state secrets laws, and tightening regulations on data handling have fostered unease among foreign business communities in China.

Jens Eskelund, president of the European Chamber in China, emphasized the exponential growth in the number and severity of risks faced by companies. Moreover, Beijing’s response to concerns raised by foreign businesses has been inadequate, particularly regarding access to government procurement contracts and data security regulations affecting medical and pharmaceutical industries.

A significant challenge arises from China’s heightened focus on national security, influencing its technological reliance and industry strategies. This stance is partly a response to U.S. measures targeting key Chinese technology firms.

European businesses are particularly troubled by China’s anti-dumping investigations into French brandy producers, while China expresses dissatisfaction with the EU’s investigation into subsidies for electric vehicles.

In the realm of cybersecurity, Eskelund criticized China’s imposition of draconian regulations, urging for a restoration of predictability in the regulatory landscape.

The report aims to facilitate constructive dialogue on de-risking and national security issues, focusing on specific industries and commodities to find common ground and foster collaboration between China and Europe.